Posts Tagged ‘buying’

Monday, September 22nd, 2014

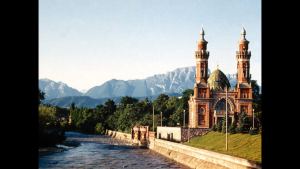

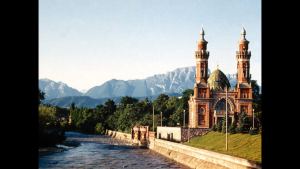

The city was founded in 1784[7] as a fortress during the Russian conquest of the Caucasus and was for many years the main Russian military base in the region.

The Georgian Military Highway, crossing the mountains, was constructed in 1799 to link the city with Georgia to the south, and in 1875 a railway was built to connect it to Rostov-on-Don andBaku in Azerbaijan. Vladikavkaz has become an important industrial center for the region, with smelting, refining, chem icals and manufacturing industries.

icals and manufacturing industries.

From 1931 to 1944 and from 1954 to 1990, its name in both Russian and Ossetic languages was Ordzhonikidze (Орджоники́дзе) (afterSergo Ordzhonikidze, a Georgian Bolshevik), and from 1944 to 1954 it was officially called Dzaudzhikau (Дзауджика́у) in Russian andDzæwdžyqæw (Дзæуджыхъæу) in Ossetic. Vladikavkaz resumed its old Russian name, in 1990, shortly before the dissolution of the Soviet Union; the official Ossetic name was reverted to Dzæwdžyqæw.

Vladikavkaz was fought over in both the Russian Civil War and World War II. In February 1919, the anti-Communist Volunteer Army under General Anton Denikin seized the city, before being expelled by the Red Army in March 1920. In November 1942, the forces of Nazi Germany tried unsuccessfully to seize the city but were repelled.

In 1999, 2008, and 2010, Vladikavkaz was a target of bombings.

Ethnic groups in the city (2002 data):[citation needed]

| Climate data for Vladikavkaz |

| Month |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Year |

| Record high °C (°F) |

19.6

(67.3) |

23.0

(73.4) |

30.3

(86.5) |

34.0

(93.2) |

35.0

(95) |

38.0

(100.4) |

37.5

(99.5) |

39.2

(102.6) |

38.2

(100.8) |

33.5

(92.3) |

27.0

(80.6) |

27.1

(80.8) |

39.2

(102.6) |

| Average high °C (°F) |

3.0

(37.4) |

3.2

(37.8) |

7.7

(45.9) |

14.8

(58.6) |

19.4

(66.9) |

23.2

(73.8) |

25.7

(78.3) |

25.4

(77.7) |

20.8

(69.4) |

15.1

(59.2) |

8.4

(47.1) |

4.3

(39.7) |

14.3

(57.7) |

| Daily mean °C (°F) |

−1.9

(28.6) |

−1.7

(28.9) |

3.0

(37.4) |

9.5

(49.1) |

14.1

(57.4) |

18.0

(64.4) |

20.6

(69.1) |

20.1

(68.2) |

15.6

(60.1) |

9.8

(49.6) |

3.6

(38.5) |

−0.7

(30.7) |

9.2

(48.6) |

| Average low °C (°F) |

−5.6

(21.9) |

−5.7

(21.7) |

−0.9

(30.4) |

5.1

(41.2) |

9.6

(49.3) |

13.5

(56.3) |

16.1

(61) |

15.7

(60.3) |

11.2

(52.2) |

5.7

(42.3) |

0.1

(32.2) |

−4.2

(24.4) |

5.1

(41.2) |

| Record low °C (°F) |

−27.2

(−17) |

−27.8

(−18) |

−22.0

(−7.6) |

−8.9

(16) |

−2.8

(27) |

2.2

(36) |

7.5

(45.5) |

6.0

(42.8) |

0.0

(32) |

−10.0

(14) |

−22.2

(−8) |

−25.0

(−13) |

−27.8

(−18) |

| Precipitation mm (inches) |

31

(1.22) |

34

(1.34) |

54

(2.13) |

85

(3.35) |

140

(5.51) |

175

(6.89) |

109

(4.29) |

89

(3.5) |

75

(2.95) |

60

(2.36) |

46

(1.81) |

31

(1.22) |

929

(36.57) |

| Avg. precipitation days |

6 |

6 |

8 |

10 |

14 |

14 |

Tags: alberta, buy, buy house, buying, comfree, condo, edmonton, house, house for rent, house for sale, investment, property, real estate, REALTOR, sell condo edmonton, sell house, Vladikavkaz, канада, купить, продать, риэлтор, русский риэлтор, русский эдмонтон, эдмонтон

Posted in Some info about Russia | Comments Off on Мой город- ВЛАДИКАВКАЗ! My city – Vladikavkaz!

Wednesday, March 5th, 2014

OTTAWA, February 28, 2014 — Following the annual review of its insurance products and capital requirements, CMHC will increase its mortgage loan insurance premiums for homeowner and 1 – 4 unit rental properties effective May 1, 2014.

The increase applies to mortgage loan insurance premiums for owner occupied, self-employed and 1-to-4 unit rental properties, including low-ratio refinance premiums. This does not apply to mortgages currently insured by CMHC.

For the average Canadian homebuyer requiring CMHC insured financing, the higher premium will result in an increase of approximately $5 to their monthly mortgage payment. This is not expected to have a material impact on the housing market.

Effective May 1st, CMHC Purchase (owner occupied 1 – 4 unit) mortgage insurance premiums will increase by approximately 15%, on average, for all loan-to-value ranges.

| Loan-to-Value Ratio |

Standard Premium (Current) |

Standard Premium (Effective May 1st, 2014) |

| Up to and including 65% |

0.50% |

0.60% |

| Up to and including 75% |

0.65% |

0.75% |

| Up to and including 80% |

1.00% |

1.25% |

| Up to and including 85% |

1.75% |

1.80% |

| Up to and including 90% |

2.00% |

2.40% |

| Up to and including 95% |

2.75% |

3.15% |

| 90.01% to 95% – Non-Traditional Down Payment |

2.90% |

3.35% |

CMHC reviews its premiums on an annual basis and, going forward, plans to announce decisions on premiums in the first quarter of each year.

95% Loan-to-Value

| Loan Amount |

$150,000 |

$250,000 |

$350,000 |

$450,000 |

| Current Premium |

$4,125 |

$6,875 |

$9,625 |

$12,375 |

| New Premium |

$4,725 |

$7,875 |

$11,025 |

$14,175 |

| Additional Premium |

$600 |

$1,000 |

$1,400 |

$1,800 |

| Increase to Monthly Mortgage Payment |

$3.00 |

$4.98 |

$6.99 |

$8.98 |

Based on a 5 year term @ 3.49% and a 25 year amortization

85% Loan-to-Value

| Loan Amount |

$150,000 |

$250,000 |

$350,000 |

$450,000 |

| Current Premium |

$2,625 |

$4,375 |

$6,125 |

$7,875 |

| New Premium |

$2,700 |

$4,500 |

$6,300 |

$8,100 |

| Additional Premium |

$75 |

$125 |

$175 |

$225 |

| Increase to Monthly Mortgage Payment |

$0.37 |

$0.62 |

$0.87 |

$1.12 |

Based on a 5 year term @ 3.49% and a 25 year amortization

Tags: alberta, buying, condo, condo for sale, edmonton, for sale, home, homes, homes in edmonton, house for sale, real estate, REALTOR, russian realtor, russian speaking, russki edmonton, selling

Posted in buying your home, For Sale By Owner FSBO, market update, selling your home | Comments Off on CMHC to Increase Mortgage Insurance Premiums

Wednesday, February 5th, 2014

The residential home inventory on the Edmonton Multiple Listing Service® (MLS® System) rose 16% in January. Typically just over 1,800 homes in the Edmonton come onto the market in January. Last month’s listings of 1,842 were higher than the 783 listed in December. Sales figures were higher than a typical January and higher than sales in December and January 2013. The increased inventory kept prices stable in all housing categories.

Compared to December, the all-residential average3 price of $347,847 was down just $1,226 or

-0.16%. Single family detached (SFD) home prices were down 1.5% at $416,344. Condominiums were priced on average3 at $230,463 (down 1.5%) and duplex/rowhouses showed the biggest movement and were down 5.3% at $336,220.

Price stability and more property available for sale results in a balanced market.Right now both buyers and sellers have time to consider all their options and housing needs. More homes are listed every day and Irina Mierzewski your russian speaking REALTOR® can advise you of a suitable property as soon as it comes available.

The residential sales-to-listing ratio was 45% and the average days-on-market was 61 days in January compared to 73 days in January 2013. There have been four property sales over a $1 million already this year but half of the SFDs sold in January were sold at or below $385,000.

Strong economic indicators such as low unemployment, higher hourly wages and positive in-migration all support an optimistic view of the Edmonton and area housing market. Consumers are confident in their economic future and prepared to risk a first-time or move-up purchase. Low rental vacancies and the potential for higher rental rates are also attracting investors into the market.

Irina Mierzewski – your russian/ukranian speaking REALTOR in Edmonton will be happy to answer all your questions and give her professional advise whether you sell or buy property in the near future.

| January 2014 |

|

M/M % Change |

Y/Y % Change |

| SFD2 average3 selling price – month |

$416,344 |

-1.50% |

4.60% |

| SFD median4 selling price – month |

$385,000 |

0.20% |

2.70% |

| Condominium average selling price |

$230,463 |

-1.50% |

6.70% |

| Condominium median selling price |

$216,500 |

-1.10% |

3.80% |

| All-residential5 average selling price |

$347,847 |

-0.20% |

6.70% |

| All-residential median selling price |

$329,500 |

0.45% |

4.60% |

| # residential listings this month |

1,842 |

135.20% |

4.20% |

| # residential sales this month (reported) |

820 |

10.00% |

-1.00% |

| # residential inventory at month end |

3,537 |

16.00% |

-5.50% |

| # Total6 MLS® System sales this month |

1,095 |

14.70% |

-11.90% |

| $ Total value MLS® System residential sales – month |

$328 million |

12.90% |

-6.50% |

| $ Total value MLS® System sales – month |

$392 million |

11.20% |

-3.80% |

| $ Total value MLS® System sales – YTD |

$392 million |

11.20% |

-3.80% |

Tags: alberta, appartment, appartments, associattion, buy, buyer, buying, canada, canadian, comfree, condo, condos, countertops, duplexes, edmonton, for sale, home, homes in edmonton, house, houses for sale, housing, investment, listings, market, MLS townhouse, properties, property, province, real estate, REALTOR, sales, selling, stats, канада, купить, недвижимость, продать, риэлтор, русский, эдмонтон

Posted in market update | Comments Off on Local housing sales and inventory up in stable market – Feb 2014

Tuesday, June 18th, 2013

Edmonton, June 4, 2013: Housing sales activity in the Edmonton Census Metropolitan Area (CMA) slowed in May. Housing sales dropped 10% when compared to May 2012. Sales of single family detached homes (SFD) were down 14.4% Y/Y and duplex/rowhouse sales were down 20.3%. In contrast, during the same period, condo sales were up 4.9% compared to May 2012.

There is a lot of activity in the real estate market at this time of year but some buyers are having difficulty finding their perfect home. While inventory levels are rising they are still below traditional norms and there is a shortage of attractive SFD inventory available at the lower priced end of the market. That has held some buyers back. First time buyers may have had to buy in the condo market where they can still find a home in their price range.

There were an estimated 1,169 SFD sales in May (based on 1,082 reported sales) through the MLS® System with 512 estimated sales of condos (474 reported) for total residential sales of 1,824 units (on reported sales of 1,689). Sales figures in the month are estimated to account for late reported sales and to ensure accurate comparison to prior period sales figures.

Listing activity picked up in May with 1,969 SFDs listed (up 1.3% Y/Y) and 963 condos (up 0.3% Y/Y) for an overall total of 3,188 residential properties coming into the MLS® System in May. At the end of May there were 6,028 residential properties available; up from 5,294 from last month. There were an additional 1,569 rural properties in the MLS® System inventory.

The demand for housing has buoyed up prices in the Edmonton area. The all-residential average price was up 2.4% from April and up 1.3% from a year ago at $356,807. The average price of SFDs was up 3.9% to $418,110 in May but condo prices dropped 2.4% from a month ago to $237,664. The condo average price is down 3.97% in May compared to last year.

Increased activity at the higher end of the market drove up the average price of SFDs. At the same time, the wide variety and number of options in the condominium sector continued to exert downward pressure on the average price of condominiums. There is housing available for everyone at every price point but buyers may have to adjust their expectations to be able to buy right now. T

The average days-on-market for residential property was down to 45 days and the sales-to-listing ratio was 53% in May.

-30-

MLS® System Activity (for all-residential sales in Edmonton CMA1)

May 2013 M/M % Change Y/Y % Change

SFD2 average3 selling price – month $418,110 3.94% 5.35%

SFD median4 selling price – month $387,750 2.31% 3.40%

Condominium average selling price $237,664 -2.40% -3.97%

Condominium median selling price $228,000 0.00% -0.87%

All-residential5 average selling price $356,807 2.37% 1.32%

All-residential median selling price $339,500 1.34% 2.11%

# residential listings this month 3,188 15.13% 1.59%

# residential sales this month 1,689 10.90% -9.97%

# residential inventory at month end 6,028 13.86% -6.67%

# Total6 MLS® System sales this month 2,365 17.43% -8.83%

$ Value Total residential sales this month $719 million 16.88% -7.62%

$ Value of total MLS® System sales – month $837 million 17.91% -8.95%

$ Value of total MLS® System sales – YTD $3.2 billion 14.13% -10.67%

1 Census Metropolitan Area (Edmonton and surrounding municipalities)

2 Single Family Dwelling

3 The total value of sales in a category divided by the number of properties sold

4 The middle figure in a list of all sales prices

5 Residential includes SFD, condos and duplex/row houses.

6 Includes residential, rural and commercial sales

Tags: apartment, buying, condo, edmonton, estate, house, market, Mortgage, rates, real, REALTOR, selling

Posted in market update | Comments Off on Local housing sales ease up in May

Thursday, May 9th, 2013

The real issue is how much money you have and how much you’re prepared to spend in order to secure the house of your future.

If you are prepared to own two homes for an extended period of time, you could buy the new Canadian house and simply wait until you sell your primary residence.

But if you’re just waiting to find the right house so that you can retire, owning two homes could be a substantial setback to your plan. And if you can’t really afford to own the two houses at once, you might be better off making sure you have a buyer for your current home before trying to buy a home.

The problem is that you still might own these two homes for some time to come. To understand how much of a liability you face, you’ll have to do an indepth study of homes that have recently sold and those that are on the market.

You can do this by looking up the prices of homes that have closed. But if you are unsure of where the real estate market is in your area, just ask me to get my thoughts on the market and how to position your home for sale.

Since you may not have your home ready to sell for almost a year, the market today could be very different from the market next summer. If the real estate market in your area is better now, you might want to consider selling soon. If the real estate market in your area is poor now, it may or may not get better next summer.

Your decision to buy hinges on whether you can see into the future to determine where the real estate market might be. I do know that owning two homes and having the expenses for those two homes is a big burden to bear particularly when you are trying to retire and scale down your home and your way of life.

Tags: agent, buyer, buying, canada, edmonton, home, house, investment, market, property, real estate, selling

Posted in buying your home, selling your home | Comments Off on Buy First or Sell First?

Wednesday, April 3rd, 2013

The REALTORS® Association of Edmonton reports that residential property prices in the Edmonton CMA1 were up again in March. The all-residential price (includes single family detached, condominiums, duplexes and row-houses) rose 3.5% in a month and single family detached prices were up 3.9%. Compared to March 2012, the all residential price was up 4.3% and the SFD price was up 7.0%.

Because of a shortage of lower priced homes, the average price is pushed up as buyers move up-market to find a home. The increase in average price may not increase the market value of a particular property. The relative number of homes sold in the $450-650k price range increased from 12.2% to 14.5% year-over-year while homes under $300,000 dropped from 40.7% of the market to 38.2%.

The average price for a single family detached home was $416,739 in March, condos were priced at $246,574 (up 6.3% m/m), duplex and rowhouses at $316,110 (down 4.9% m/m) and the all-residential average price was $354,759. SFD prices peaked in May of 2007 at $424,400.

The demand for homes in the Edmonton area continues to be driven by net job creation and low unemployment, economic stability and low rental vacancy rates. Sales were brisk with the sales-to-listing ratio up at 57% for March which indicates that almost six of the ten homes listed during the month were sold. Days-on-market was down from 57 in February to 50 in March.

The number of homes available for sale in the MLS® System inventory was up from 4,183 to 4,741 in March. While this is an increase of 558 properties from last month, it is down 15.4% from the same time last year. The lower inventory is exerting upward pressure on prices but has a dampening effect on sales. “When first time buyers cannot find a house that meets their needs or are forced into a multiple offer situation, they often remain on the sidelines. Low interest rates and rising rental rates create the interest and desire but lack of suitable properties means they are not able to make the transition to home ownership at this time.

REALTORS® are facing some multiple offer situations on lower-priced property but overall, the market remains in balance with neither buyers nor sellers having an advantage in most neighbourhoods.

Residential sales in the Edmonton CMA were up 1.14% in March as compared to March 2012. There were 1,497 estimated sales (1,386 reported) on listings of 2,422 during the month. SFD sales were down 6.63% from last year but condo sales more than compensated at 8.84% y/y increase. Note that sales numbers are estimated to reflect late reported sales and make a more accurate comparison with prior month actual sales.

MLS® System Activity (for all-residential sales in Edmonton CMA1)

| March 2013 |

|

M/M % Change |

Y/Y % Change |

| SFD2 average3 selling price – month |

416,739 |

3.93% |

7.03% |

| SFD median4 selling price – month |

380,000 |

1.20% |

4.40% |

| Condominium average selling price |

246,574 |

6.34% |

7.53% |

| Condominium median selling price |

229,500 |

8.03% |

4.32% |

| All-residential5 average selling price |

354,759 |

3.51% |

4.30% |

| All-residential median selling price |

329,700 |

0.84% |

2.00% |

| # residential listings this month |

2,422 |

21.40% |

-14.93% |

| # residential sales this month |

1,386 |

37.50% |

-6.35% |

| # residential inventory at month end |

4,741 |

13.34% |

-15.41% |

| # Total6 MLS® System sales this month |

1,822 |

33.58% |

-8.30% |

| $ Value Total residential sales this month |

$569 million |

40.02% |

-2.54% |

| $ Value of total MLS® System sales – month |

$644 million |

36.88% |

-5.17% |

| $ Value of total MLS® System sales – YTD |

$1.458 billion |

39.82% |

-4.81% |

Tags: alberta, appartment, associattion, buy, buying, canada, comfree, condo, duplexes, edmonton, home, homes in edmonton, house, investment, market, MLS townhouse, property, real estate, sales, аренда, бизнес, дом, жилье, канада, квартира, культура, купить, маклер, общество, община, помещение, провинция, продажа, продать, риэлтор, русская, русские, русско-говорящий риэлтор, рынок, снять, статистика, цены, эдмонтон

Posted in market update, selling your home | Comments Off on Housing prices and sales up in active, but balanced market

Tuesday, March 19th, 2013

Canada is one of the best countries in the world for home ownership. We are now clearly the fastest growing nation in the G8 regarding immigration as recently reported in the Globe and Mail. Canada is setting its sights on an annual immigration of 400,000 people by 2016 up from the current 320,000.

The demand for home ownership across all provinces will be significant for decades. As Canadians we can feel confident that our home will continue to be a place where we raise our families, have our dreams come true and remain a cornerstone of our life long financial wellbeing, despite what the media would like us to believe.

The U.S. economy is showing signs of consistent growth with housing starts and new jobs leading the charge. This of course bodes well for us and is particularly welcome news for our manufacturing and resource sectors.

So the economy on both sides of the border looks promising, immigration will continue to add to the growth of Canada and interest rates are historically low. Regardless of what some might want us to think Canada is Still the Best Place to Own a Home!

If you know anyone who is looking to buy a home, it’s important that they get pre-approved today! The spring market is fast approaching and there is evidence everywhere of a pent up demand. Having that pre-approved mortgage in hand can give someone the advantage over other buyers.

Call or email me today!

Tags: alberta, appartment, appartments, associattion, buy, buying, canada, canadian, comfree, condo, countertops, duplexes, edmonton, homes, homes in edmonton, house, how to, immigration, investment, kitchen, landlord, market, MLS townhouse, owners, prices, properties, property, province, real estate, REALTOR, rental, resale, sell, stats

Posted in buying your home | Comments Off on Canada is Still the Best Place to Own a Home!

Thursday, September 6th, 2012

Edmonton, September 5, 2012: Residential property sales in August slowed both month-to-month and year-to-year, mirroring a trend that has evolved nationally all summer. Sales of all types of residential properties in August (1,430) were down 17.4% from July and down 10.7% from a year ago. The number of people offering their properties for sale also slowed but not as sharply as sales. There were 2,732 residential properties listed on the Multiple Listing Service® in August; down 2.2% from a month ago and down just 5.6% from a year ago. The available inventory was reduced 2.9% to 7,458 properties.

“Housing sales across Canada have dropped slightly since May,” said REALTORS® Association of Edmonton President Doug Singleton. “The sales activity varies from market to market and it appears, when compared to last year that Edmonton is slowing faster than the national trend after a very active spring. Never-the-less, housing prices are still up from a year ago and consumer confidence is high.”

Despite the slowdown in sales, prices were up as compared to August 2011. The average* selling price of a single family detached home (SFD) was down marginally (-0.15%) at $384,477 from last month but up 3.8% from a year ago. Condo prices were also down marginally (-0.9%) from last month at $237,042 but up from last year. The all residential average price was $334,395 (down 0.5% m/m) which is up 3.2% from August 2011.

Average prices are affected by the difference in price of similar properties as well as the market composition or mix of homes sold. Compared to a year ago, a typical bungalow in August sold for 2.2% more while a typical 2-story home sold for about 3.2% more. While the price of an individual home was rising, the market composition was also changing. In August 2012, 53% of SFDs sold were priced below $375,000 as compared to 59% in 2011. In addition, the number of sales of homes over $500,000 was up from 11% in 2011 to almost 15% this year.

“August sales illustrate the changes in the composition of the market,” said Singleton. “More consumers are purchasing homes at the higher end of the market. This is an indicator of consumer confidence and a long term view that this market is stable. ”

The average days-on-market in August was up two at 54 days. The sales-to-listing ratio was down, moving down from 62.0% in July to 52.3%.

Tags: appartment, buy house, buying, comfree, condo, edmonton, for sale, house, invest, market, MLS, real estate, REALTOR, search, selling

Posted in market update | Comments Off on Edmonton’s slower market activity matches national trend

Tuesday, May 8th, 2012

Путь к продаже вашего дома лежит через Кухню

Продавцы

понимают, что путь к сердцу потенциального покупателя лежит через кухню. За многие

годы, кухня стала тем самым местом, где за большим столом собирается вся семья,

где готовится завтраки обеды и ужины, где собираются друзья и конечно же где

дети делают свое домашнее задание. Таким

образом, одним из самых многомерных и

функциональных комнат в доме является кухня.

Её ремонт и привлекает внимание многих

покупателей, которые хотят увеличить стоимость перепродажи дома в будущем, или просто улучшить свои

условия и уют в доме.

Хотя,

надо сказать, что продавцы чаще не хотят связывать себя в дополнительным

расходом и вложением времени перед продажей дома. Согласгл проведенным

исследованиям, ремонт кухни приносит 75-100% возврата на вложенные деньги, т.е.

второй после ремонта ванной.

К счастью. Ремонт дома не такой уж сложный проект как некоторым может показаться.

С увеличением центров «сделай сам» можно экономически эффективным способом

увеличить стоимость вашего дома без высоких цен на квалифицированного

специалиста.

Вот несколько шагов, которые вы можете предпринять.

По

Rona.ca, кухонные шкафы являются одной из лучших инвестиций, которые можно

сделать в доме. Для многих покупателей недвижимости первые впечатления происходят

на кухне. Потратив чуть больше на качественныекухонные шкафы и ручки для них, можно ожидать, что ваши

инвестиции в вознаградят вас сторицей.

Покрасив стены и шкафы на кухне, в случае еслы вы не собираетесь их менять,

можно изменить внешний вид кухни с минимальными затратами и сделать комнату

более просторной.

Светильники и люстры часто являются одними из последних вариантов улучшения на

кухне, но часто про них забывают, когда кухня отремонтирована. За счет

добавления новых источников света на кухне, можно объединить архитектурный и

декоративный баланс в комнате. Хорошим освещением можно выделить некоторые

особенности кухни, такие как Backsplash или рабочую стенку сделаную камнем или

мозаикой, чтобы создать более яркий и привлекательный вид.

Каждой кухне нужна раковина и смеситель. Но когда речь идет о перепродаже дома,

только некоторые из продавцов видят ценность в замене раковины. Кран и

раковина является одним из наиболее важных особенностей кухни. Когда покупатели

входят в комнату, они, естественно тяготеют к раковине и проверяют краны.Это

дает чувство домашнего очага, особенно потому, что они тратят большую часть

своего времени на кухне.

И напоследок, статистика по Эдмонтону и

прилежащих районах:

В Апреле 2012 года вышло на рынок 3253

резидентских листинга. Из них продалось 1713. Это значит, что продается 53%

домов.

Среднее количество дней на маркете

составило 50.

С акрейджами и вне городскими продажами

чуть сложнее – выставлено было 648 участков с домами, продалось только 165 –

т.е. 25%. Среднее количество дней составило 82.

Самыми популярными районами в Эдмонтоне

стали северо-центральный со 153 продажами и ср ценой $347,645, Юго-восток

города – 134 продажи со ср ценой $357,040

и юго-западный со 117 продажами и ср ценой $521,778

На конец апреля активных листингов по

эдмонтону и районам – 7,334. Если в среднем продается с среднем 1800 домов в

месяц, то инвентории у нас сейчас предостаточно на следущие 4 месяца.

Покупатели, у вас все еще есть большой выбор!

Если у вас есть вопросы – пишите,

звоните, я всегда отвечу.

Удачных сделок!!!

Ирина Миерзевски

780-991-9764

www.irinahomes@live.com

irinahomes@live.com

РИЭЛТОР® ABR®

Realty Executives Polaris

New

FreeAPP for iPhone “Edmonton MLS®” search for your new home on your mobile!

Tags: alberta, appartments, buying, by, comfree, condo, for sale, homes in edmonton, house, housing, how to, investment, landlord, market, owners, province, rent, rental, selling

Posted in RUSSIAN/РУССКИЙ | Comments Off on Путь к продаже вашего дома лежит через кухню

icals and manufacturing industries.

icals and manufacturing industries.